Got your first paycheck or just started your business or even saved some money doing part-time jobs, it’s one of those notable moments of your life when you earn something on your own. It’s the time to chase your dreams and do things that you enjoy and at the same time, you should not forget to invest. Investing regularly is a great way to build a considerable corpus in the long run and will help you achieve financial freedom earlier.

Now that you have decided to start investing, you will search for the best investment products available in the market. You will see tons of results, some with high risk, some with moderate. You will think about which one is the best according to your needs.

Whether you are just starting or a pro at investing, you can’t ignore the power of Index Funds. As the investment world evolves, more investors are turning to index funds as a viable option to grow their wealth.

This article will help you explore the concept of index funds meaning, what is in an index fund, their benefits, risks, investment strategies, index funds returns and their potential impact on the future of investing.

Understanding Index Funds

What are index funds?

They are investment funds that are designed to track the performance of a specific market index. For example, consider NIFTY 50. NIFTY 50 is a basket of stocks of those companies which are the 50 largest companies of India or S&P 500, it contains stocks of the largest 500 companies of the USA. Simply put, they are a basket of stocks which copies those indexes. That is, whatever stocks are present in indexes, the same stocks will be present in the Index Fund basket.

Now these baskets (Indexes) can be of any type, it can contain top tech stocks. NIFTY IT is one of those indexes which contain stocks of top IT companies of India. Similarly we can have indexes for top banks of the country, indexes for large, mid and small cap companies.

Also, one need not worry about the hefty management fees as they are passively managed, which means Fund Managers need not actively do the rebalancing of the stocks or choose stocks on their own. Instead, they just need to copy the stocks already present in Indexes thereby reducing the expense ratio.

Types of index funds

There are several types of Indexes for example IT Index, Banks Index, and Large Cap companies index. Many Index funds are available for us to invest in any of the given indexes. We can choose the specific type according to our needs and how much risk we can handle and how long we want to stay invested.

Advantages of Investing in Index Funds

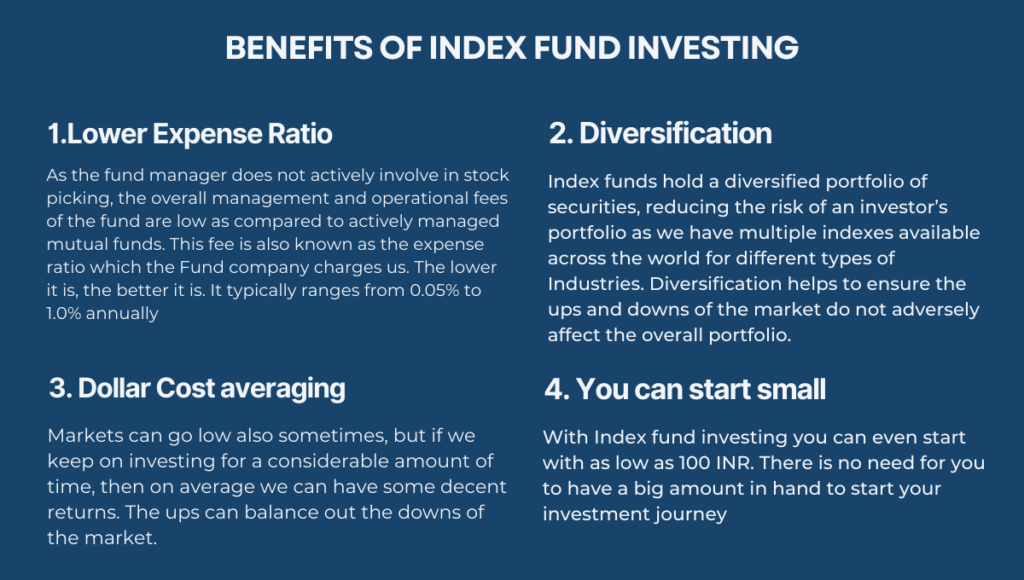

Lower Management fees

They have lower management fees than actively managed funds, typically ranging from 0.05% to 1.0% annually, which in turn can directly impact our profits.

Diversification

They hold a diversified portfolio of securities, reducing the risk of an investor’s portfolio. Diversification helps to ensure the ups and downs of market do not adversely affect the overall portfolio.

Passively Managed

They are passively managed meaning that fund managers do not re-balance the fund or work on it regularly. They don’t do the stock picking, instead, just mimic the underlying index.

Index Funds Returns

Like stocks, Index funds may also fluctuate but in the medium to long term, they are one of the best investment options to diversify your overall portfolio risk factor. Over some time, you can experience consistent average returns.

You can start small

With Index fund investing you can even start with as low as 500 Rs. There is no need of you to have a big amount in hand to start your investment journey

Differentiating Index Funds from Other Investment Options

Actively Managed Mutual funds

Mutual funds are actively managed funds where fund managers pick stocks on their own. Actively managed Mutual funds charge higher management fees than index funds, making them less profitable for investors in many cases.

Exchange-traded funds (ETFs)

ETFs also track an underlying index. However, ETFs trade like stocks, in the stock market, you can buy and sell them just like a stock while Index funds do not trade in the stock market.

Investment Strategies

Dollar-cost averaging

In this strategy we keep on buying the units of Index Funds regularly, we will sometimes buy when the market is at a high and sometimes at a low regardless of the price. This way, on average, we will be able to see some good profits. The key factor here is consistency and patience.

Lump-sum investment

This involves investing a large amount of money all at once instead of at regular intervals. This strategy is best suited for those who don’t have regular payouts or have a bigger amount of cash in hand.

Asset allocation

This involves dividing your investments across different asset classes. A well-diversified portfolio is critical to managing risk.

Rebalancing

This strategy involves selling the funds that have outperformed and booking the gains and at the same time looking out for funds that are available at lower prices and buying them. This rebalancing you can do from time to time when you think either the market is at a high or low respectively.

Risks Associated

Market risk

The risk of the market is present with any investment, including Index funds. A big dip in the market can lead to our profits also dipping low but with time recovery can happen

Rebalancing risk

While rebalancing is an important part of maintaining a well-diversified portfolio, it carries the risk of being out of sync with the market during rebalancing periods.

Tracking error risk

Tracking error is the difference between the performance of the index fund and the real performance of the underlying index. While index funds aim to track the index closely, tracking error is always present.

How to Select a Top Performing Index Fund

Create your investment goal

Your investment goal would determine the type of fund that you should consider investing in. Whether you have a short, mid or long-term goal will decide the type of index fund you need to choose. In many cases, the risk associated with the fund is directly proportional to the time that you give to the respective fund.

Know your risk tolerance

Your risk tolerance would determine the kind of fund you select. If you can withstand the lows of the market and can even stay invested during those times, then your risk tolerance is high. Similarly, we can have low and medium risk tolerance. Our risk tolerance will define how long we can invest our money in the fund and consequently, it will impact our returns too.

The fund’s performance track record

The fund’s performance track record is a critical factor to consider when selecting an index fund. Investors can review the fund’s historic performance by checking the fund’s fact sheet or their official website.

Total Expense ratio

The expense ratio is the fees that we need to pay to the company from which we are buying the Index fund. It generally includes the Index Fund Manager’s fees and operational costs. All such costs for running and managing a mutual fund scheme are collectively referred to as the ‘Total Expense Ratio’ (TER). The lower it is, the better it is for us.

Tracking error

It is the difference between the performance of the index fund and the real performance of the underlying index. You can check this for a given fund on the funds official website. It should be as low as possible in order to perfectly replicate the underlying index.

How Index Funds can change the way you invest

Passive Investing can save you loads of money

The growth of these funds and other passive investment options has led to a shift away from active management. This will surely lead to a decline in hefty management fees which one needs to pay to mutual fund houses.

Lot of options are available

The index fund industry has evolved significantly in recent years, with new index options and a wide range of investment strategies available to investors. New indexes are being introduced which will broaden this market.

Impact of index funds on the overall financial market

Index funds have had a significant impact on the overall financial market, contributing to the trend of passive investing, reduced fees, and increased access to diversified investment options.

The Future of Index Funds

The potential growth in the future

The growth of these funds is expected to continue for the foreseeable future as investors look for low-cost investment options that provide consistent returns.

The role of technology in index fund investing

Technology can improve the efficiency of trade executions, lower fees, and streamline communication between investors and fund managers.

The future outlook for investors

The future outlook for investors is bright, with low-cost, diversified portfolios becoming more accessible to large and small investors alike.

Common Myths About Index Funds

Index funds are only for beginners

While these funds are easy to understand, they are a viable investment option for all types of investors. Successful investors often include these funds in their diversified portfolios.

Index funds are not profitable

They have consistently delivered returns that match the underlying index performance, making them a profitable investment option.

Index funds carry high risks

While there are risks associated with any investment, index funds carry less risk due to their diversified portfolio and low-cost structure.

Conclusion

Index funds are low-cost, diversified, and passively managed investment options designed to track the performance of a selected market index. This article discussed the benefits and risks of choosing index funds as an investment option, and how to select a suitable index fund. We also explored the impact of the future of index funds. Finally, we compared our funds with other investment options available In the market

FAQ

What are index funds?

They are investment funds that track the performance of a specific market index, such as the S&P 500 or NIFTY 50.

Is an index fund a safe investment option?

While no investment is entirely safe, index funds carry fewer risks than other investment options due to their diversified portfolio and low-cost structure.

How do index funds differ from other investment options?

They are passively managed, charge lower fees, and aim to track the performance of a specific market index. Other options, such as mutual funds and managed funds, are more actively managed and charge higher fees.

What factors should I consider when selecting an index fund?

When selecting an index fund, investors should consider their investment goals, risk tolerance, the fund’s performance track record, and the fund’s expense ratio.

How have index funds changed the investment market?

They have contributed to the trend of passive investing, leading to reduced fees and increased access to diversified investment options.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Please consult a qualified professional before making financial decisions