When you start managing money, everything will seem overwhelming. This is especially so when the expenses start piling up. But it need not be like that always. With proper budgeting, everything can be simplified and made efficient like never before. In identifying and implementing the right financial habits, it is possible that you can regain full control of your cash flow and stress. What’s more, you can even find some space to enjoy doing things you’ve always wanted to. As we are already in 2025 and looking forward to 2026, now is the time to make some strategies that will make money management a breeze.

In the section below, I will be sharing with you the top 10 practical hacks that are not only easy to follow but can make a difference to you.

Best Budgeting Hacks to Kickstart Your Finances

1. Automating your savings

Leaving everything to chance can be detrimental. Therefore, if possible, try setting up automated transfers from your salary account into your savings account. Once correctly set, this can become an effortless way to manage your finances.

2. Try a budget planner

It doesn’t matter which budget planner you wish to use – a notebook or a digital template- they can help you a lot in understanding where your income is going. These planners are also a great way to break down expenses into categories, which in turn will give you a lot of clarity.

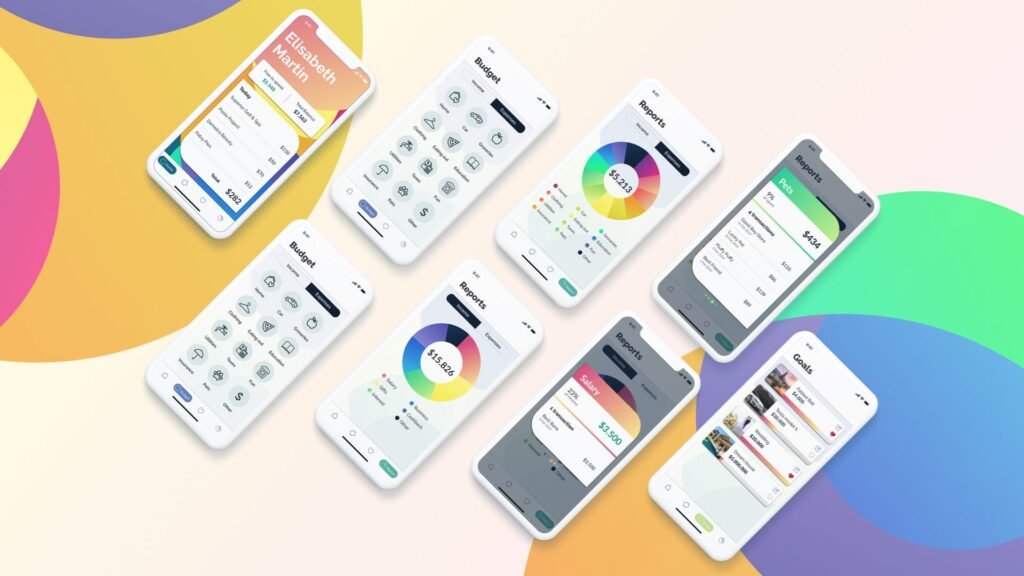

3. Budgeting apps

There are plenty of apps available for budgeting these days. The best thing about these apps is that they are intuitive. Some of these apps are also AI-driven and provide valuable insights into your spending and saving habits. A majority of these apps come up with useful features like automatic bill reminders, spending alerts, etc.

4. Make use of a zero-based budget

In this method, you will be assigning every rupee to a job – savings, bills, food, or rent. The idea is that your balance should hit zero at the end of every month with no money slipping away from you for lame reasons.

5. Expense tracker

Expense trackers offer you a realistic way to monitor your daily expenses. Even the smallest and unnoticed purchases that you may have made will end up adding to your expenses. In a dedicated expense tracker, you can see this pattern. This can, in turn, be used for cutting down on wasteful spending.

6. Establish an emergency cushion

In life, we may face unexpected costs. Therefore, to be on the safer side financially, it is better to have a safety net. Ideally, you should set aside three to six months of expenses to ensure you don’t fall into the debt trap.

7. Bulk buying and Meal planning

It can help you a lot when you plan things out. For example, when you plan your meals, it will not only save your valuable time but also reduce grocery bills. Similarly, when you buy grocery items in bulk, you will end up saving money.

8. Apply easy cost-cutting hacks for your monthly budget

A lot of difference can be achieved when you do some simple things right. For example, cancelling unused subscriptions, cooking at home, negotiating utility bills, etc, can go a long way in preventing cash burns. These minor adjustments will help stabilise your financial health without compromising your lifestyle.

9. Learning how to budget on a low income in 2025

Money may not always be with you. This is perfectly fine. However, the key is to prioritise essentials. You can always look for creative ways of stretching a rupee whilst celebrating small achievements along the way. Making modest progress helps build a lot of confidence in managing personal finance.

10. Understanding the difference between needs and wants

This advice may seem like a classic one, but it is still true. Splurging on a cold coffee here and making an impulsive shopping there may not seem much, but when you actually cut on wants, you end up making a lot of room for your needs.

Final Thoughts

When you roll your head towards budgeting, it does not have to feel like punishment. There are a lot of simple and easy-to-follow hacks that will help you save money without letting you worry about the future. The trick is in maintaining consistency – using a mix of trackers and budgeting hacks that work. The journey will not always be about perfection; it is all about progress.