The inflation rate hikes we have seen recently have sent shockwaves through global economies. Thanks to these hikes, people have now changed the way they earn, spend, and save. Prices of essentials have been increasing at a much faster rate than incomes. Therefore, with each passing month, the cost of living feels heavier than it was before. Remember, inflation is not just about numbers. In fact, it is a reality that has prompted households to change their budgets and business houses to alter their strategies. With so many changes happening everywhere, it has become important to understand the ripple effects of inflation. Given below are five urgent impacts that need your attention.

The Real Cost of Rising Prices

Your wallet gets affected directly and immediately with the inflation. Amongst the first visible impacts are seen in the cost of living. Be it rent or fuel, healthcare or groceries, all of them will seem to cost a bit more to you than before. This trend slowly but surely eats away at your purchasing power, making it difficult to get on with the same lifestyle with the same income.

The purchasing power decline comes with its own set of problems. This means even if your salary remains the same, it cannot be stretched any further. This is when the real income erosion comes to the fore. As your money starts losing its value, it becomes difficult for you to save. When this happens, people start to cut corners, focus only on basic needs, and skip non-essential items. To put it in simple words, inflation prompts people to change their priorities, and not just the prices.

Inflation Rate Hikes and the Central Bank Response

Across the world, central banks have their own way of tackling inflation. This usual way is to raise interest rates so that borrowing becomes difficult and the already overheating economy is given time to cool down substantially. This approach is referred to as interest rate response. Though it’s considered effective theoretically, the challenges they present are unique.

Generally, people start delaying big-ticket purchases like cars or homes, when the borrowing costs go up suddenly. Even businesses bare the brunt of this situation as they start to postpone new hires or expansion plans. These quick measures are usually undertaken to reduce demand and give a chance for the prices to stabilise.

The reality is that it is a delicate balance. The growth of the economy can be stalled if rates climb quickly. From the central banks’ perspective, this game of precision becomes a high-stakes one; with the margin error being small.

Ripple Effects Across the Economy

It is not just the prices; the effects of inflation can be seen across different areas of the economy. For example, companies may be forced to increase their product prices with rising input costs, just to maintain their profit margins. This trend leads to consumer price growth, which indicates the reduction of household spending power.

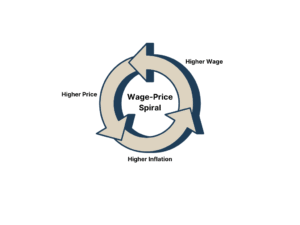

Workers, on their part, start demanding higher wages to combat inflation. According to economists, this situation is referred to as a wage-price spiral. With production costs going up and rising wages, companies are prompted to increase prices. This cycle continues to worry one and all.

The challenge before the government is a two-fold one: to protect consumers from skyrocketing prices while keeping the economic growth on track. Occasionally, governments resort to tax breaks or subsidies. However, their help is limited. At the end of the day, you need market confidence, policy discipline, and a lot of patience to break the vicious cycle of inflation.

Final Thoughts

The inflation rate hikes touch everyone – be it consumers, investors, or policymakers. There is no escaping this trend. Also, when this happens, prices rise, borrowing becomes difficult, and financial decisions become complicated. However, one has to understand that there exists a small room for resilience.

With every passing year, people are becoming smarter. They start spending cautiously and invest with great caution. In all, financial literacy is fast-emerging as a shield to protect against uncertainties caused by inflation.

1 thought on “Inflation Rate Hikes: 5 Urgent Impacts You Can’t Ignore”

Pingback: Green Finance Opportunities: 6 Powerful Trends for Portfolio