When it comes to managing debt, one of the most popular approaches is the debt snowball. However, there are other equally popular approaches, like debt avalanche, that provide an alternate method to tackle balances. Though both these approaches are designed to help you tackle debts effectively, they work differently. Therefore, they appeal differently to people. If you were to choose the perfect strategy to assist you in your financial journey, you need to understand each of its strengths and weaknesses.

How the Debt Snowball Method Works

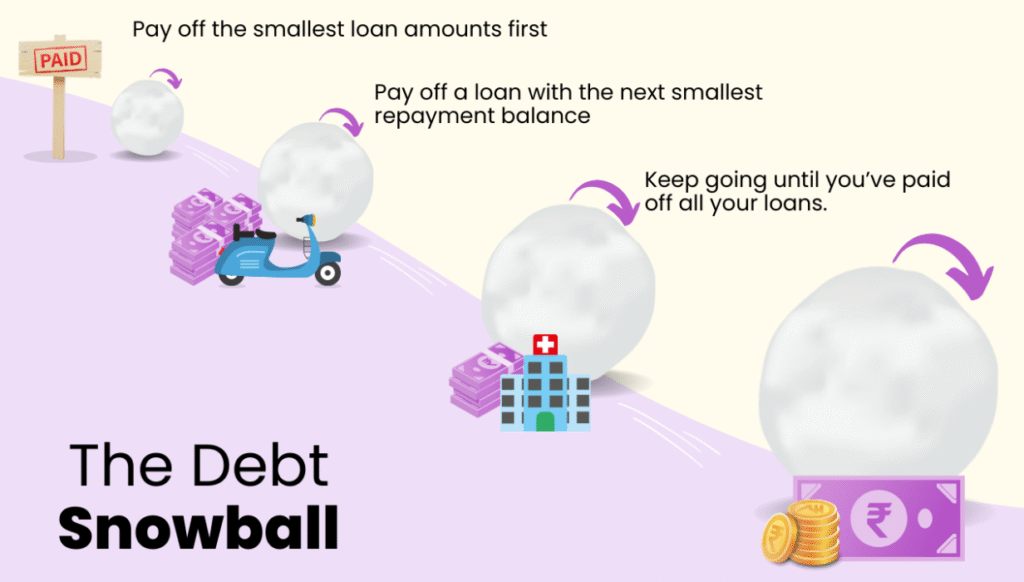

In the debt snowball method, the user will first focus on paying off the smallest balances. During this time, the minimum payments on other debts are made concurrently. After the smallest balance is cleared, the freed-up amount is rolled over into the next smallest debt. This cycle continues.

So, what is the benefit of this approach? It is basically the psychological benefit that a user is likely to experience with this approach. When an individual sees the debt disappearing one by one, the momentum created by quick wins ensures he is motivated. For a large number of people, emotional boosts like these prompt them to stick to a debt strategy a lot more easily.

So, what are the downfalls of this approach? As the high-interest accounts are not targeted initially, individuals may end up paying a lot of interest. Nonetheless, for people who need to remain motivated, the debt snowball approach comes to the rescue.

Figuring Out the Debt Avalanche Approach

The focus of the debt avalanche approach, on the other hand, is on the math. Individuals who follow this approach will not focus on the smallest debt first. Instead, they add extra money toward the balance that has the highest interest rate. This will be done while covering minimums on other accounts. The next highest rate will be targeted after the more costly debt is taken care of.

One clear advantage this approach has over the other approach is interest savings. When you follow this approach, you will end up paying less in total. What this means is that your money is used to lower your balances. The other side to this approach is that it might take longer to see the actual progress. This is especially true if the highest-interest debt is also the biggest. For many people, the delay in results would mean working much harder than before to stay motivated, even though this approach is a smart one when you look at it financially.

If you were to take the words of financial experts seriously, then the avalanche approach provides the biggest benefits, especially when you look at it from a total debt repayment point of view. However, figuring out whether this approach is best for you totally depends on your patience levels, as the progress seen in this approach is slow.

Which Strategy is the Best One and When to Choose

So, which strategy is the best for you? It all depends on what motivates you the most. The avalanche approach works out the best for you if you aspire to minimise interest levels and save money over time. Some of the biggest pay off debt results are seen in this approach.

On the other hand, if you want to remain consistent without worrying about the actual progress you made, then the snowball method will work for you. When small balances are taken care of, you will experience a sense of accomplishment after knocking out small balances quickly.

Final Thoughts

Whether you choose the debt snowball method or the debt avalanche, you need to understand that they are proven methods for tackling debts. While one of them provides you with psychological ones, the other provides financial efficiency. The ideas have to focus on which approach matches your lifestyle and mindset better, instead of focusing mainly on saving money.

1 thought on “Debt Snowball vs. Debt Avalanche: Which Strategy Saves More Money?”

Pingback: Creative Ways to Earn Extra Income: Side Hustles in 2025