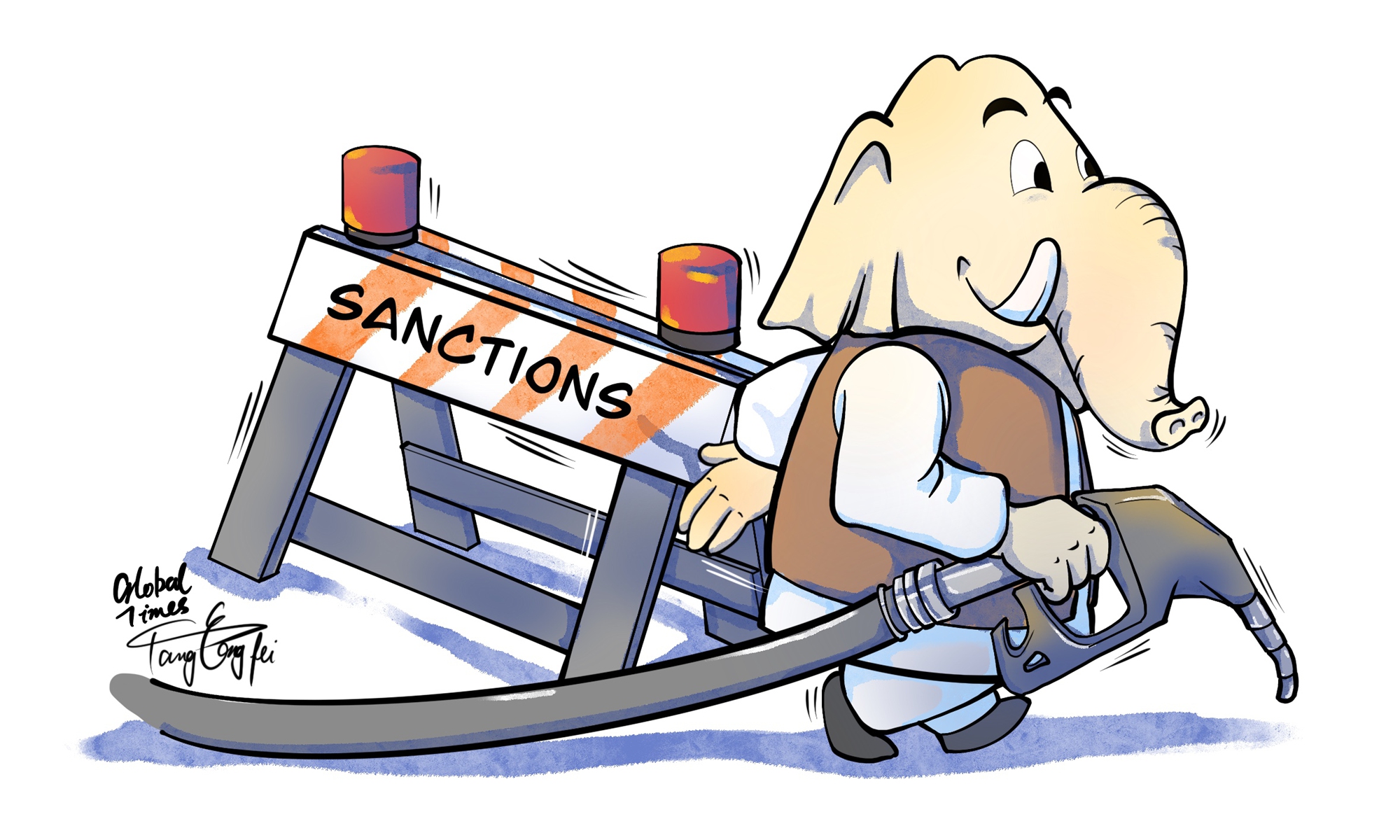

President Donald Trump has cranked up the tariff heat on India and in typical Trump fashion, the U.S. President took to his favorite megaphone, social media, to launch a direct attack on India’s trade policies, its military purchases from Russia, and its growing appetite for Russian oil, amplifying his message – play ball, or pay the price.

In a series of posts on Truth Social, Trump accused India of imposing sky-high tariffs and hiding behind what he called “strenuous and obnoxious” non-monetary trade barriers. He also took aim at India’s long-standing defense ties with Moscow, noting that New Delhi has become one of Russia’s biggest energy buyers, alongside China, at a time when the West is urging Putin to pull back from Ukraine.

“India is our friend,” Trump wrote, “but we’ve done relatively little business with them because their tariffs are far too high… and they keep buying weapons and oil from Russia. All things NOT GOOD!”

And Tariffs Again..

The latest tariffs – 25% across the board on all Indian imports, plus an unspecified “penalty” for its energy dealings with Russia, comes just after the U.S. wrapped up trade deals with Japan and the European Union. Those agreements may have given Trump confidence that he can squeeze more out of his remaining partners, and India seems to be next in line.

Indian negotiators have been shuttling between Washington and New Delhi for months, hoping to hammer out a deal. At times, it seemed like a breakthrough was within reach. But with Trump’s August 1 deadline, and no firm deal in place, the mood has shifted from optimistic to uncertain.

According to sources familiar with the talks, the sticking point is simple: Trump wants full access for American producers – no half-measures. “They’re willing to go part of the way,” said one U.S. official, “but the president isn’t in a ‘part of the way’ mood.”

Meanwhile, behind the scenes, there’s little doubt that Trump is prepared to let the tariffs kick in. It’s part of his broader strategy, exerting maximum pressure to bend even close allies into making deeper concessions. It’s not personal, it’s transactional. And with the U.S. still the largest consumer market on the planet, Trump knows he’s got leverage.

Kevin Hassett, Director of the National Economic Council, didn’t mince words. Speaking at the White House on Wednesday, he said Trump is “frustrated” with India’s pace but believes the tariffs will force a rethink. “Over time,” he said, “I’d expect Indian firms to start onshoring production in the U.S. And maybe, just maybe, they’ll open their markets more to us.”

Not To Be Pushed Over…

Despite Trump’s bombastic approach, New Delhi is refusing to break a sweat. The Indian government’s response to the 25% duties and the vague but ominous “penalty” tied to Russian oil purchases has been strikingly calm. If Washington expected panic, what it got instead was a patient shrug.

So, what is behind this composure?

Unlike some of its regional peers, India hasn’t jumped into a deal just because the U.S. offered one. While Japan and the EU scrambled to strike last-minute arrangements with Washington, India held its ground, especially on one of its most politically sensitive fronts: agriculture.

India has made it clear that opening up its markets to U.S. agricultural products is simply not an option, not now, and not under pressure. With millions of small farmers forming a crucial political base, giving in to American agribusiness would be like handing opposition parties a loaded weapon.

And India’s recent trade deal with the U.K. proves this point. Despite the pomp and pressure, New Delhi protected its most sensitive agricultural sectors from any tariff concessions, sending a strong message that it won’t compromise domestic interests for diplomatic brownie points.

Carlos Casanova, senior economist at UBP, broke it down bluntly: India isn’t backing off because it doesn’t have to. “The U.S. accounts for a relatively small portion of India’s total exports. And opening up agriculture to American firms is a red line,” he said. According to U.S. government figures, India’s goods exports to the U.S. were around $87.4 billion in 2024, a significant number, yes, but hardly a make-or-break pillar of India’s economy.

Commerce and Industry Minister Piyush Goyal echoed this sentiment in a recent interview, where he made it crystal clear: protecting farmers and MSMEs (Micro, Small and Medium Enterprises) comes before anything else. “We are always very sensitive to the interests of our farmers… and will ensure our areas of concern are well protected,” he said.

Goyal also threw cold water on Washington’s ticking-clock tactics. “India does not negotiate trade deals based on deadlines,” he stated, adding that while a deal with the U.S. would be welcome, India’s national interest would not be compromised to meet an artificial timeline. His prediction whispers of a better deal (on India’s terms) by October or November 2025.

And it’s not just talk. India’s recent trade agreement with the U.K. is being held up as a template for how New Delhi intends to deal with all Western powers going forward: calmly, confidently, and on its own terms.

Russia, Oil, and the Penalty Nobody’s Naming (Yet)

As Trump ratchets up tariff threats, he’s also dangling a much bigger stick: secondary sanctions on countries buying Russian oil. It’s not a new idea, it’s been toyed with by past U.S. administrations, but Trump appears dead serious this time – stop buying Russian oil, or get caught in the crossfire.

Hence, India, which has been unapologetic about its energy deals with Moscow, is in the direct line of fire. Russian crude now makes up around 35–37% of India’s oil imports, more than from any other nation. For a country that’s laser-focused on energy security and keeping inflation in check, that’s not a relationship it can easily walk away from.

India’s refiners, both public sector giants like Indian Oil Corp and Bharat Petroleum, and private players like Reliance Industries, have been snapping up discounted barrels from Russia, helping to cushion domestic fuel prices and fatten up refining margins. But if Trump’s “penalty” includes a hard cutoff or sanction risk on Russian oil, India’s entire strategy could be upended.

The pressure isn’t subtle. Earlier this month, Trump gave Russia a 50-day deadline to halt its Ukraine campaign, warning that any country still buying Russian oil beyond that date would face consequences. That deadline now slides to August 8, and Treasury Secretary Scott Bessent is already reinforcing the message.

“I think anyone who buys sanctioned Russian oil should be ready for this,” Bessent told reporters at a press conference in Stockholm. In other words: this isn’t a bluff.

According to the Centre for Research on Energy and Clean Air, India is the second-largest buyer of Russian fossil fuels, trailing only China. So yes, this “penalty” is personal.

Who Stands to Lose the Most in India’s Economy?

Trump’s 25% tariff threat throws cold water on New Delhi’s hope for preferential treatment, especially after months of high-level trade talks and Prime Minister Modi’s much-hyped White House visit back in February.

A Bloomberg report, citing Indian internal calculations, estimated that about 10% of Indian exports could be hit in Q3 alone if the tariffs go through. With two-way U.S.-India trade hitting $129.2 billion in 2024, the ripple effects could be wide-ranging, especially in sectors where India has long held a competitive edge. For example, gems & jewelry, pharmaceuticals, textiles & apparel, electronics, and oil refining.

India’s Cards…

Bringing manufacturing back to the U.S., especially from China, has been a central tenet of Donald Trump’s economic playbook. In this context, India has emerged as a key alternative to China in the global manufacturing arena.

“We still expect India to remain a beneficiary of the ‘China plus one’ strategy, as diversification is a bigger driver of this trend,” noted Asia Insight, a market research firm, in a recent report.

Hence, India’s role in managing this great power rivalry is “very, very critical”. As the U.S. attempts to de-risk its supply chains from China, India represents a strategic compromise, geographically well-placed, diplomatically pragmatic, and economically ambitious. This co-production model could help India “cut China out” and allow the U.S. to position itself more strategically while India continues to walk its own tightrope.

Walking the BRICS Tightrope

At the same time, India’s delicate dance within the BRICS alliance (which now includes Brazil, Russia, India, China, South Africa, and newer additions like Egypt and Ethiopia) offers it some flexibility in bilateral dealings with the U.S. However, it’s also where global loyalties get tested.

According to the Carnegie Endowment for International Peace, BRICS is increasingly working to challenge Western-led global institutions and reduce the dominance of the U.S. dollar. On July 6, Donald Trump threatened to impose a 10% additional tariff on countries aligning with the “anti-American policies of BRICS,” even as Prime Minister Modi was attending the bloc’s summit in Brazil.

Trump doubled down on the rhetoric days later, warning that he would “hit BRICS very, very hard” if they ever “really form in a meaningful way.” “We can never let anyone play games with us,” he declared.

Within the group, China sees India as a competing power, vying for influence and leadership. But from Washington’s viewpoint, India can play a valuable role as a counterbalance to Beijing, especially if it helps dilute BRICS’ ambitions of creating an alternative reserve currency to rival the U.S. dollar.

That alone could be a critical bargaining chip. As Mizuho’s Varathan explained, “India could convince Trump that they’re not on board with the alternate currency plan,” which might incentivize him to treat New Delhi with more diplomatic leniency.

India’s Plan B: The Multi-Alignment Strategy

Amid the growing uncertainty in U.S.-India trade relations, India is quietly stitching together a broader fallback strategy. As part of its “multi-alignment” approach, it is accelerating talks with other global players.

India has already finalized a trade deal with the UK and is in advanced negotiations with the European Union, the Maldives, and several other partners. “This is part of India’s increased turn toward a multi-alignment strategy,” said Sarang Shidore, director of the Global South program at the Quincy Institute.

At the same time, India continues to emphasize its strategic ties with the U.S., which it still considers a vital partner. This diversified diplomacy gives India more leverage at the negotiating table especially when facing high-pressure tactics or tariff threats.

More than just a hedging tactic, this reflects India’s evolving worldview: that of a rising power unwilling to be boxed into any single geopolitical camp. One that seeks to maintain its strategic autonomy while championing the Global South on the world stage.

India’s Next Strategy?

Trump’s tariff threats mark a dramatic inflection point in U.S.-India trade relations, but not an irreversible one. Here’s how this could unfold across key scenarios:

1. India Absorbs the Shock, Then Regroups

If the 25% tariffs kick in, sectors like gems, pharma, electronics, and apparel will be hit hard. But India is unlikely to capitulate immediately. Instead:

—Expect short-term disruptions, job losses, and margin compression in key export sectors.

—India may re-route supply chains, deepen ties with the EU/UK, and seek trade diversification.

–Domestically, this will strengthen Make-in-India and PLI (Production-Linked Incentive) programs to replace lost U.S. demand with other markets or local consumption.

–India has dealt with similar shocks before (e.g., GSP withdrawal in 2019) and didn’t fold then—it won’t now either.

2. Strategic De-escalation: Quiet Diplomacy, Delayed Retaliation

Trump’s style is pressure-first, deal-later. India may:

—Wait Trump out until after U.S. elections or his second-term clarity.

—Use BRICS diplomacy and oil pricing as leverage to negotiate sectoral exemptions (like pharma, IT).

—Offer limited market access (excluding agriculture) in exchange for tariff rollback or phased relief.

—India could even strike behind-the-scenes assurances on Russian oil purchases in exchange for softening penalties, something it has done before with Iran sanctions.

3. The BRICS Card: India Hedges Further, But Doesn’t Flip

India won’t abandon BRICS or the Global South, but it won’t go fully anti-West either.

Expect strategic ambiguity on the BRICS currency issue – India will delay, dilute, or dissent without formally exiting.

This will allow New Delhi to tell Washington: “We’re not with China on this.” That message may buy breathing room from Trump.

4. Domestic Politics Take Priority

Indian elections are due in 2029, but state elections and domestic sentiments matter now.

Any U.S. pressure on agriculture, MSMEs, or oil subsidies is politically toxic.

Expect no movement on agri imports or energy compromise, especially if the BJP wants to hold rural states.

India will choose domestic stability over external appeasement, especially under threat.

Can Trump Really Do Without India?

Short-term – maybe. Long-term – absolutely not!

Here’s why: India = China Diversification

India is central to Washington’s China+1 strategy. Trump wants to cut Beijing out of U.S. supply chains but you can’t replace China with Ohio alone. India is the largest scalable, democratic alternative in Asia.

Therefore, no India = no real China decoupling.

2. Trade War Blowback Hurts U.S. Too

Indian generics keep U.S. healthcare costs down.

Indian engineers and firms are critical to Silicon Valley’s ecosystem.

Tariffs may hurt American consumers and companies, not just Indian exporters.

Tariff war with India is a lose-lose for both economies, especially in pharma, IT, and consumer goods.

3. BRICS Leverage

If Trump pushes too hard, he risks pushing India deeper into BRICS.

That could:

Accelerate dollar de-dollarization efforts.

Undermine G7 control over global trade and finance.

Leave the U.S. isolated as India builds new economic architectures.

Trump may talk tough, but he can’t afford to let India go to the other side.

4. The Indo-Pacific Geopolitics

India is a bulwark against China in the Indo-Pacific. The Quad (U.S.-India-Japan-Australia) is meaningless without India. If Trump loses India’s trust, he loses Asia and hands strategic space to Beijing and Moscow.

5. Diaspora & Political Optics

Indian-Americans are a rising political force in key swing states like Texas, Florida, and Georgia. Hostility to India could alienate this bloc and hurt Trump at home, especially with high-profile GOP donors in the Indian-American community.

The Last Bit,

Trump may push India hard with tariffs and secondary sanctions but India’s new global posture isn’t that of a submissive partner. It’s a self-confident, rising power that knows how to withstand pressure.

India won’t blink. And in the long run, Trump can’t afford to treat India the way he treats China or Europe. He needs New Delhi, for supply chains, for counter-China strategy, and for keeping BRICS from becoming a true anti-U.S. bloc.

Hence, without saying it loud or admitting it openly, here are two powers who need each other, but refuse to admit it.